Tips for Choosing the Right Health Insurance Plan

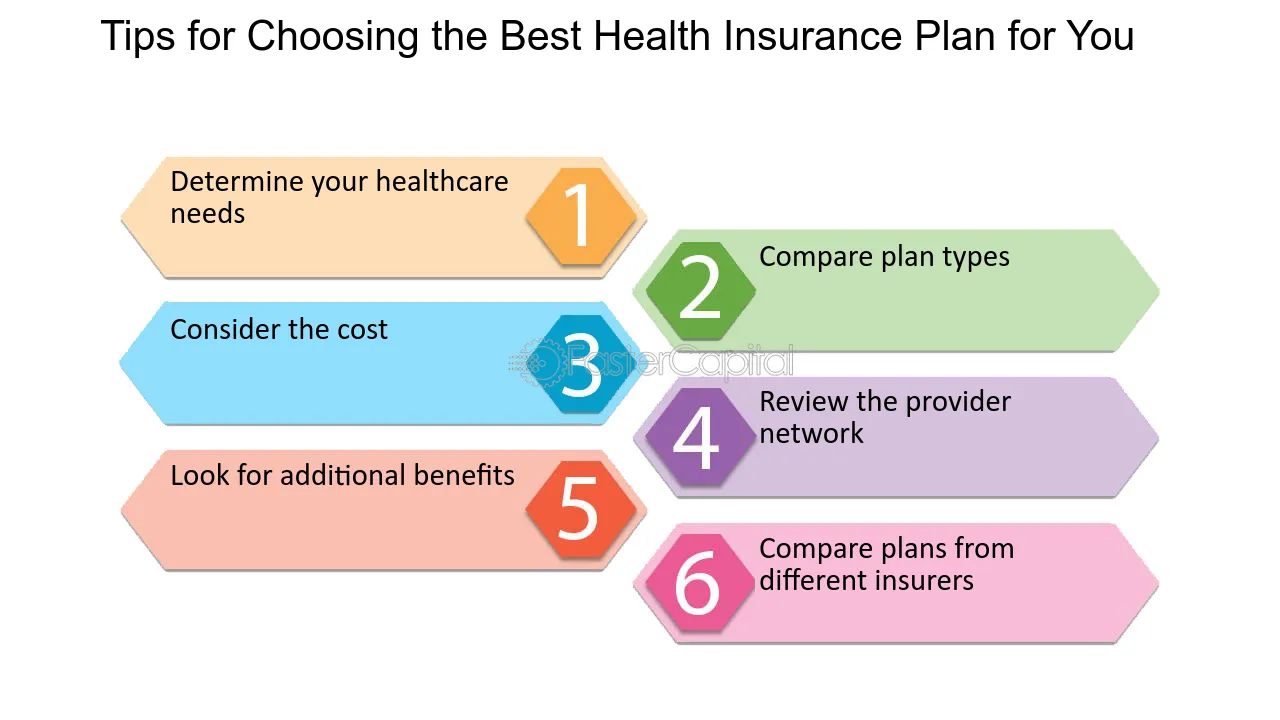

Choosing the right health insurance plan is a crucial decision that can significantly impact your health, finances, and peace of mind. With a myriad of options available, it can be overwhelming to navigate the complexities of different plans, coverage options, and networks. Whether you’re enrolling for the first time, switching plans, or reevaluating your current coverage, understanding how to select a health insurance plan that best fits your needs is essential.

This article offers practical tips for evaluating health insurance plans and making an informed choice that aligns with your health needs, budget, and lifestyle.

1. Understand Your Health Care Needs

The first step in selecting a health insurance plan is to evaluate your own health care needs. Consider the following factors:

- Current Health Conditions: If you have chronic conditions like diabetes, hypertension, or asthma, you may need a plan that provides comprehensive coverage for ongoing treatments, prescriptions, and specialists.

- Planned Medical Procedures: If you anticipate surgery, maternity care, or specialized treatments, it’s essential to ensure your plan covers these services adequately.

- Frequency of Doctor Visits: If you visit the doctor frequently for check-ups or treatments, you might need a plan with a lower copayment and more convenient access to primary care physicians and specialists.

- Prescription Medications: Ensure the plan covers the medications you currently take, as prescription drug costs can vary widely between plans.

Knowing these aspects will help guide your search for a plan that can provide the best coverage for your specific situation.

2. Consider the Types of Health Insurance Plans

Health insurance plans come in different types, each with its advantages and limitations. Here are the most common types:

- Health Maintenance Organization (HMO): HMO plans generally have lower premiums and out-of-pocket costs, but they require you to select a primary care physician (PCP) and get referrals to see specialists. They also limit coverage to a network of doctors and hospitals, so out-of-network care may not be covered unless in emergencies.

- Preferred Provider Organization (PPO): PPO plans offer more flexibility by allowing you to see any doctor, including specialists, without a referral. However, seeing in-network providers will cost less. PPOs generally have higher premiums and deductibles than HMOs.

- Exclusive Provider Organization (EPO): EPO plans combine aspects of HMOs and PPOs. They don’t require referrals, but they also only cover care provided by in-network doctors and hospitals, except in emergencies.

- Point of Service (POS): POS plans are a hybrid of HMO and PPO plans. You choose a primary care physician, but you can seek care from out-of-network providers, although you’ll pay higher costs for doing so.

- High Deductible Health Plans (HDHP): These plans feature higher deductibles and lower premiums. HDHPs are often paired with Health Savings Accounts (HSAs) that allow you to save money tax-free for medical expenses. These plans may be ideal for healthy individuals who don’t require frequent medical care.

Understanding the differences between these plan types will help you determine which one is the best fit for your lifestyle, budget, and healthcare needs.

3. Review the Network of Providers

One of the most critical aspects to consider when choosing a health insurance plan is the provider network. Health insurance plans have networks of doctors, hospitals, and other healthcare providers that they have agreements with to offer services at reduced rates. The cost of medical services is usually lower when you use in-network providers.

- In-Network vs. Out-of-Network: Check whether the plan includes your preferred doctors and hospitals in its network. If you have a particular doctor or hospital that you trust, make sure they are included in the plan’s network. If you choose a plan with a limited network, it might be harder to find a provider that meets your needs.

- Out-of-Network Care: Some plans, especially PPOs, offer out-of-network care, but at a higher cost. If you prefer flexibility or want access to specialists outside the network, this could be a consideration.

- Access to Specialists: If you need to see a specialist regularly, ensure that the plan covers access to those specialists and that the referral process (if required) is clear and manageable.

4. Compare Costs

Health insurance plans come with a variety of costs, including premiums, deductibles, copayments, and coinsurance. Understanding the total cost of each plan is critical to making an informed decision.

- Premiums: The premium is the amount you pay monthly for health insurance. Plans with lower premiums often have higher deductibles and out-of-pocket costs. Conversely, plans with higher premiums generally have lower deductibles and cost-sharing.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance begins to cover costs. A high-deductible plan may be cheaper in terms of premiums but could leave you with significant out-of-pocket costs if you require medical care.

- Copayments and Coinsurance: These are the amounts you pay when you receive medical services, such as a $20 copayment for a doctor’s visit or 20% coinsurance for a surgery. Compare the copayments and coinsurance for each plan to determine what will be affordable for you.

- Out-of-Pocket Maximum: This is the most you’ll have to pay for covered health services in a policy period (usually a year). Once you reach this maximum, the insurance covers all additional costs for covered services. Plans with lower out-of-pocket maximums can offer more protection against unexpected medical costs.

5. Check Coverage for Essential Services

Different plans vary in the services they cover. Ensure the plan you choose provides coverage for essential services such as:

- Preventive Care: Many insurance plans cover routine check-ups, vaccinations, and screenings without charging a copayment or coinsurance, even before you meet your deductible.

- Mental Health Services: Coverage for mental health services, including therapy, counseling, and psychiatric care, is crucial for many individuals. Check if the plan provides adequate mental health care and substance use treatment coverage.

- Maternity and Newborn Care: If you’re planning on having a child, verify that the plan includes maternity and newborn care. This coverage can be essential, especially if you require prenatal care, delivery, and postnatal care.

- Emergency Services: Ensure the plan covers emergency medical services, such as ambulance rides and emergency room visits, especially if you plan to travel or live in a remote area.

6. Understand the Plan’s Prescription Drug Coverage

Prescription drug coverage is another important factor. Review the plan’s formulary (list of covered medications) to see if it includes the medications you take regularly.

- Tiers of Medication: Many plans categorize medications into tiers based on cost, with generics at the lowest cost and brand-name drugs at higher tiers. Make sure your medications are covered under the most affordable tier.

- Mail-Order Pharmacy Options: Some plans offer discounts or additional convenience through mail-order pharmacies for chronic medications. If you take medication regularly, this can save you money and time.

- Specialty Medications: If you require specialty drugs (e.g., for cancer, HIV, or autoimmune diseases), make sure the plan covers these medications and understand the out-of-pocket costs.

7. Check for Additional Benefits and Services

Some health insurance plans offer additional benefits beyond basic medical care. These may include:

- Wellness Programs: Many insurers offer wellness programs, such as discounts on gym memberships, smoking cessation programs, weight management services, and mental health apps.

- Telemedicine: Telemedicine services allow you to consult with a doctor remotely, which can be particularly valuable for minor illnesses or if you live in a rural area.

- Dental and Vision Coverage: Some health plans include dental and vision coverage, while others require separate plans. If these services are important to you, be sure to check whether they’re included or if they need to be purchased separately.

8. Evaluate the Insurance Provider’s Reputation

The quality of customer service, the ease of the claims process, and the overall reputation of the insurance provider matter. Check online reviews and ratings of the insurer, and ask friends or family members about their experiences with the company.

Look for factors such as:

- Claims Process: Is the insurer easy to work with when filing claims? Some insurers have a reputation for denying claims or complicating the process, so research their customer service history.

- Network Adequacy: How wide is the network? A narrow network may restrict your access to healthcare providers, while a broad network provides more flexibility.

- Financial Stability: You want to choose an insurer that is financially stable and has the ability to pay claims when you need them. Independent rating agencies like A.M. Best and Standard & Poor’s provide insight into an insurer’s financial health.

9. Consider Future Needs and Life Changes

Health insurance isn’t static. Consider potential changes in your health, family, or employment situation. For instance:

- Marriage, Children, or Divorce: If you’re planning on expanding your family or going through a life change like marriage or divorce, you may need to adjust your coverage.

- Job Changes: If you’re changing jobs, you might lose or gain access to employer-sponsored insurance. Compare your employer’s offerings with individual plans to find the best fit.

Conclusion

Selecting the right health insurance plan is a personal decision that requires careful consideration of your health, budget, and long-term needs. By understanding your healthcare requirements, comparing plan types, assessing costs, reviewing provider networks, and considering additional benefits, you can make an informed decision. Remember, it’s not just about finding the cheapest option—it’s about finding the plan that

provides the best value for your unique situation. Taking the time to research and ask questions will ensure you have the coverage you need when you need it most.