Comparing Public vs. Private Health Insurance: A Comprehensive Overview

Health insurance is one of the most crucial components of modern society, providing individuals with access to necessary healthcare services while also serving as a financial safety net. As countries around the world continue to evolve their healthcare systems, two primary models for health insurance dominate the global landscape: public and private health insurance. Both systems have distinct advantages and drawbacks, depending on the country, socioeconomic factors, and the health needs of individuals. This article will provide a comprehensive comparison of public and private health insurance, focusing on their structure, benefits, challenges, costs, and impact on overall health outcomes.

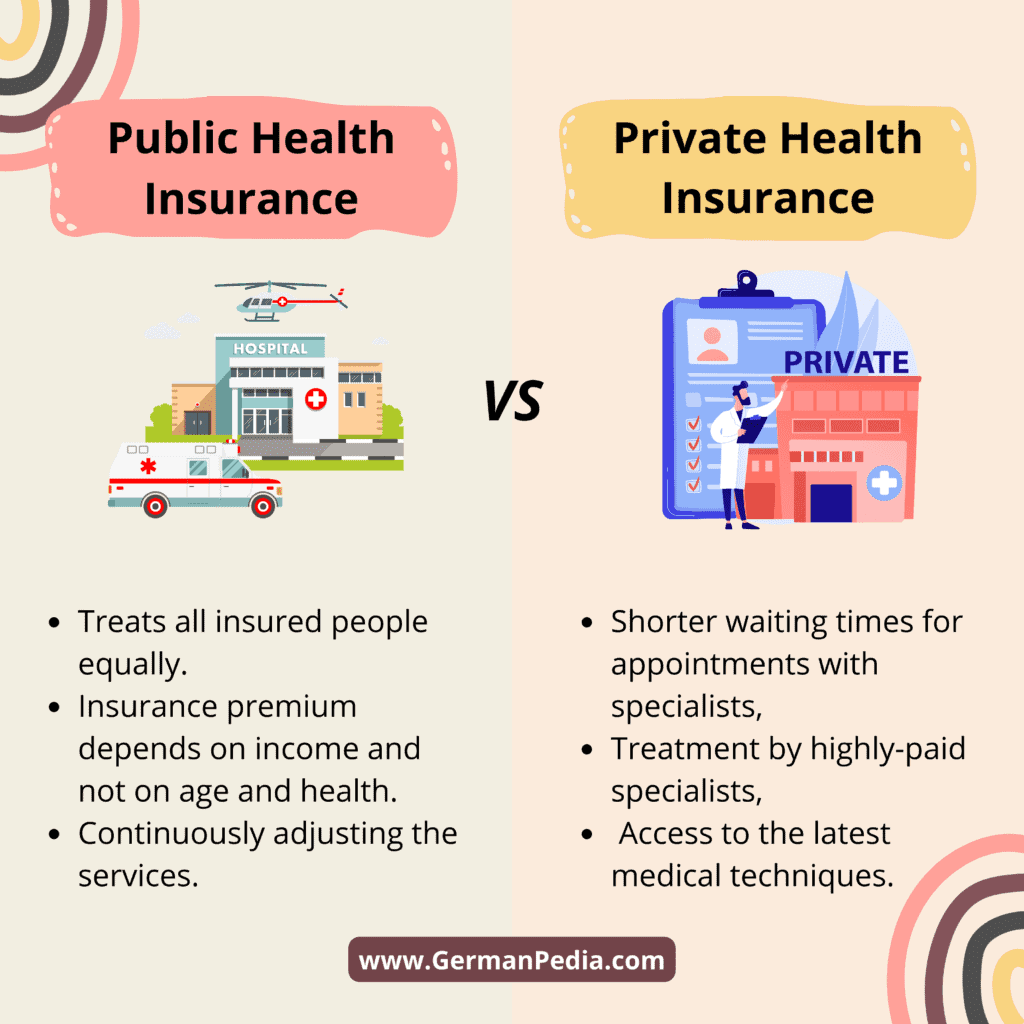

1. Understanding Public Health Insurance

Public health insurance, also known as national health insurance or single-payer systems, is typically funded and managed by the government. Under such a system, healthcare services are provided to all citizens or residents of a country, often free or at a low cost at the point of service. The primary objective of public health insurance is to ensure universal access to healthcare, regardless of an individual’s income, employment status, or pre-existing conditions.

Structure of Public Health Insurance

In public health insurance systems, the government is the central body responsible for financing and organizing healthcare. Some examples of countries with strong public health insurance models include:

- United Kingdom: The National Health Service (NHS) provides healthcare that is funded primarily through taxes.

- Canada: Canada’s Medicare system is publicly funded and provides universal health coverage for all Canadian citizens.

- Germany: Although Germany has a multi-payer system, the government plays a significant role in regulating healthcare, and many individuals are covered by statutory health insurance.

Public health insurance is generally characterized by:

- Universal Coverage: Everyone within the country is eligible, regardless of income or employment status.

- Tax-Funded: Healthcare is financed through taxes collected from the working population, businesses, and sometimes specific levies.

- Cost Control: The government often negotiates the cost of healthcare services, medications, and hospital treatments to ensure affordability.

Advantages of Public Health Insurance

- Universal Access: Public insurance systems provide healthcare coverage to all citizens, preventing any individual from being excluded due to financial constraints.

- Cost Efficiency: Administrative costs tend to be lower in public systems because the government is the primary payer, which can result in significant savings. Private insurance often involves more complex administrative overheads.

- Equity and Fairness: Public health insurance aims to reduce health disparities by ensuring that even individuals in lower-income brackets receive the care they need. Everyone is treated equally based on medical need, not ability to pay.

- Preventive Care: Public health insurance systems tend to emphasize preventive care, as they can reduce overall long-term healthcare costs by focusing on early interventions and health promotion.

Challenges of Public Health Insurance

- Long Wait Times: One of the biggest criticisms of public health insurance is the potential for longer wait times for medical procedures, especially in systems with heavy demand. In countries like the UK and Canada, non-urgent procedures can be delayed due to limited resources.

- Limited Choice: Public insurance systems may offer limited choices regarding doctors, hospitals, and treatment options, as patients are generally required to use the public system’s providers.

- Funding Constraints: As healthcare costs rise globally, public systems may face financial pressures, leading to budget cuts, reduced services, or even healthcare rationing.

2. Understanding Private Health Insurance

Private health insurance, on the other hand, involves individuals or employers purchasing insurance policies from private companies to cover healthcare services. Unlike public insurance, private insurance is typically voluntary, and coverage is based on the premiums that individuals or businesses pay. Private insurance models vary widely across countries, but they are often seen as a way to augment or supplement the public health system, or, in some cases, as a complete alternative.

Structure of Private Health Insurance

Private health insurance systems operate under a market-driven model. People select from a variety of insurance providers and plans based on their needs and ability to pay. Private health insurance is common in countries like:

- United States: The U.S. has a predominantly private health insurance system, though it has public programs like Medicare and Medicaid for the elderly, poor, and disabled.

- Switzerland: Swiss residents are required to buy private health insurance, but the government regulates the plans to ensure access and affordability.

- Australia: While Australia has a public health insurance system (Medicare), many Australians purchase private health insurance to access quicker or more specialized services.

Private health insurance is typically characterized by:

- Premium-Based: Individuals pay monthly premiums, which are often based on age, health status, and the level of coverage.

- Choice and Flexibility: Policyholders often have the freedom to choose their healthcare providers, including specialists and private hospitals.

- Supplementary Insurance: In many countries, private insurance supplements public health insurance, offering quicker access to care, choice of treatment, and enhanced benefits.

Advantages of Private Health Insurance

- Access to a Broader Range of Services: Private insurance often provides access to a wider variety of services, including specialized care, elective treatments, and advanced medical technologies that might not be available under a public system.

- Shorter Wait Times: Patients with private insurance generally experience shorter waiting times for non-emergency medical treatments and elective surgeries.

- Choice and Flexibility: Private insurance allows patients to choose their healthcare providers, which can lead to a more personalized healthcare experience.

- Quality of Care: In many cases, private hospitals and doctors are able to provide a higher standard of care, as they are less burdened by the same volume of patients as public healthcare systems.

Challenges of Private Health Insurance

- High Costs: Private insurance can be expensive, particularly in countries like the U.S. where insurance premiums, co-pays, and deductibles can place a significant financial burden on individuals, even for basic care.

- Inequity: Private insurance can exacerbate health inequalities. Those who cannot afford private insurance are often relegated to the public system, where they may face longer wait times and fewer treatment options.

- Complexity: Navigating private insurance plans can be confusing, as there are often numerous options with varying levels of coverage, exclusions, and restrictions.

- Exclusion of Pre-existing Conditions: Some private insurers may not cover individuals with pre-existing health conditions, or they may impose higher premiums or exclusions based on an individual’s health status.

3. Comparing Costs

Public Health Insurance Costs

Public health insurance is generally funded through taxes, which means that individuals pay for their coverage indirectly. The government determines the rate of taxation, which can vary depending on income levels. While the direct costs of healthcare may be low or nonexistent at the point of service, individuals still contribute through taxes.

In some countries, the government may introduce co-pays or charges for certain services, but these fees are often modest and are designed to keep the system sustainable without creating financial barriers to care.

Private Health Insurance Costs

Private health insurance requires individuals to pay premiums on a regular basis, which can vary significantly depending on factors such as the level of coverage, the insurance provider, and the individual’s age and health condition. Private insurance premiums can range from affordable to prohibitively expensive, especially in high-cost countries like the U.S.

Moreover, private health insurance often includes out-of-pocket expenses such as deductibles, co-pays, and coinsurance, which can add up quickly. While private insurance may offer faster access to care and a broader range of services, these added costs can result in significant financial strain for families.

4. Impact on Health Outcomes

Public and private health insurance systems can have differing impacts on health outcomes. Countries with well-implemented public health systems, such as Canada and the UK, generally show higher life expectancy rates and lower infant mortality compared to countries with predominantly private insurance systems, such as the U.S.

However, the key challenge for public health systems is balancing universal access with the demand for services. Overcrowded systems can lead to delays in treatment and reduced health outcomes for patients who have to wait for necessary care.

Private health insurance can lead to better short-term outcomes for individuals, particularly for elective surgeries and specialized treatments. However, when large segments of the population are left uninsured or underinsured, the overall health outcomes of a society may suffer. Private insurance can lead to disparities in care, with wealthier individuals receiving higher-quality care while low-income individuals face greater challenges in accessing services.

5. Hybrid Models

Many countries operate hybrid systems that combine both public and private health insurance. For instance, in Germany and France, there is a basic public health insurance plan available to all citizens, but individuals can purchase additional private insurance for faster access to care or enhanced services.

In Australia, Medicare provides universal public health coverage, but private insurance is encouraged through tax incentives, allowing individuals to opt for private care if they prefer.

Hybrid systems aim to strike a balance between the equitable, universal coverage of public insurance and the choice, flexibility, and reduced wait times offered by private insurance.

Conclusion

The debate between public and private health insurance is complex, with both models offering distinct benefits and facing unique challenges. Public health insurance systems emphasize universal coverage, equity, and cost-efficiency but may struggle with wait times, limited choice, and funding constraints. Private health insurance, on the other hand, offers flexibility, shorter wait times, and a broader range of services but often at a high cost and with the potential to exacerbate health disparities.

The most effective health insurance system depends on the specific needs and goals of each country. Some nations benefit from a predominantly public system, while others rely on private insurance to fill gaps in coverage